Editorial Note: This article is written based on topic research and editorial review.

- What Is Decoding the 10-Year Treasury Note?

- Why Decoding the 10-Year Treasury Note Is Trending

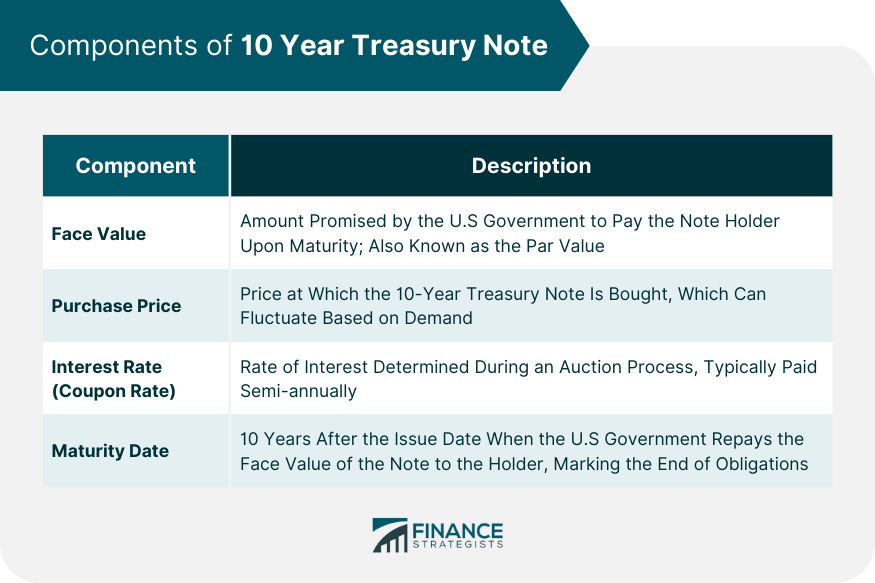

- Key Details of the 10-Year Treasury Note

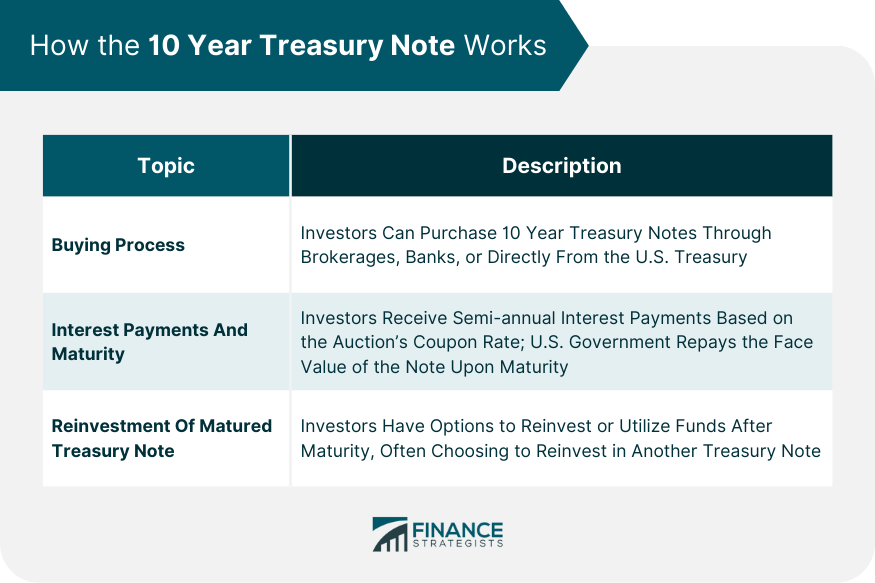

- How To Monitor and Understand the 10-Year Treasury Note

- What To Expect From Understanding the 10-Year Treasury Note

- The Broader Impact of Decoding the 10-Year Treasury Note

- Economic or Social Insights

- Frequently Asked Questions About Decoding the 10-Year Treasury Note

- Conclusion

Lead: In the intricate world of finance, few indicators hold as much sway as the 10-year Treasury note. Often referenced in economic reports and market analyses, its yield serves as a critical barometer for everything from mortgage rates to global investor sentiment. This comprehensive guide delves into decoding the 10-year Treasury note, offering an ultimate resource for understanding its profound importance and far-reaching implications. Readers will gain crucial insights into why this seemingly simple government debt instrument is a cornerstone of the financial landscape and how its movements directly influence economic stability and personal financial decisions.

Conclusion

The 10-year Treasury note is far more than just a government bond; it is a vital economic signal, a global benchmark, and a direct influencer on the financial well-being of millions. Its continuous movement and the narratives derived from its yield are indispensable for comprehending the current state and future trajectory of the economy. Understanding how to decode this critical instrument equips individuals with a powerful tool for navigating the complexities of the financial world, making informed decisions, and appreciating the intricate dance between government policy, market forces, and everyday economic realities. Its consistent prominence underscores its enduring significance as a pillar of financial analysis.