Editorial Note: This article is written based on topic research and editorial review.

- What Is Breaking Down the Latest Interest Rate Hikes

- Why Breaking Down the Latest Interest Rate Hikes

- Dates, Locations, or Key Details

- How To Get Involved or Access Breaking Down the Latest Interest Rate Hikes

- What To Expect

- The Broader Impact of Breaking Down the Latest Interest Rate Hikes

- Economic or Social Insights

- Frequently Asked Questions About Breaking Down the Latest Interest Rate Hikes

- Conclusion

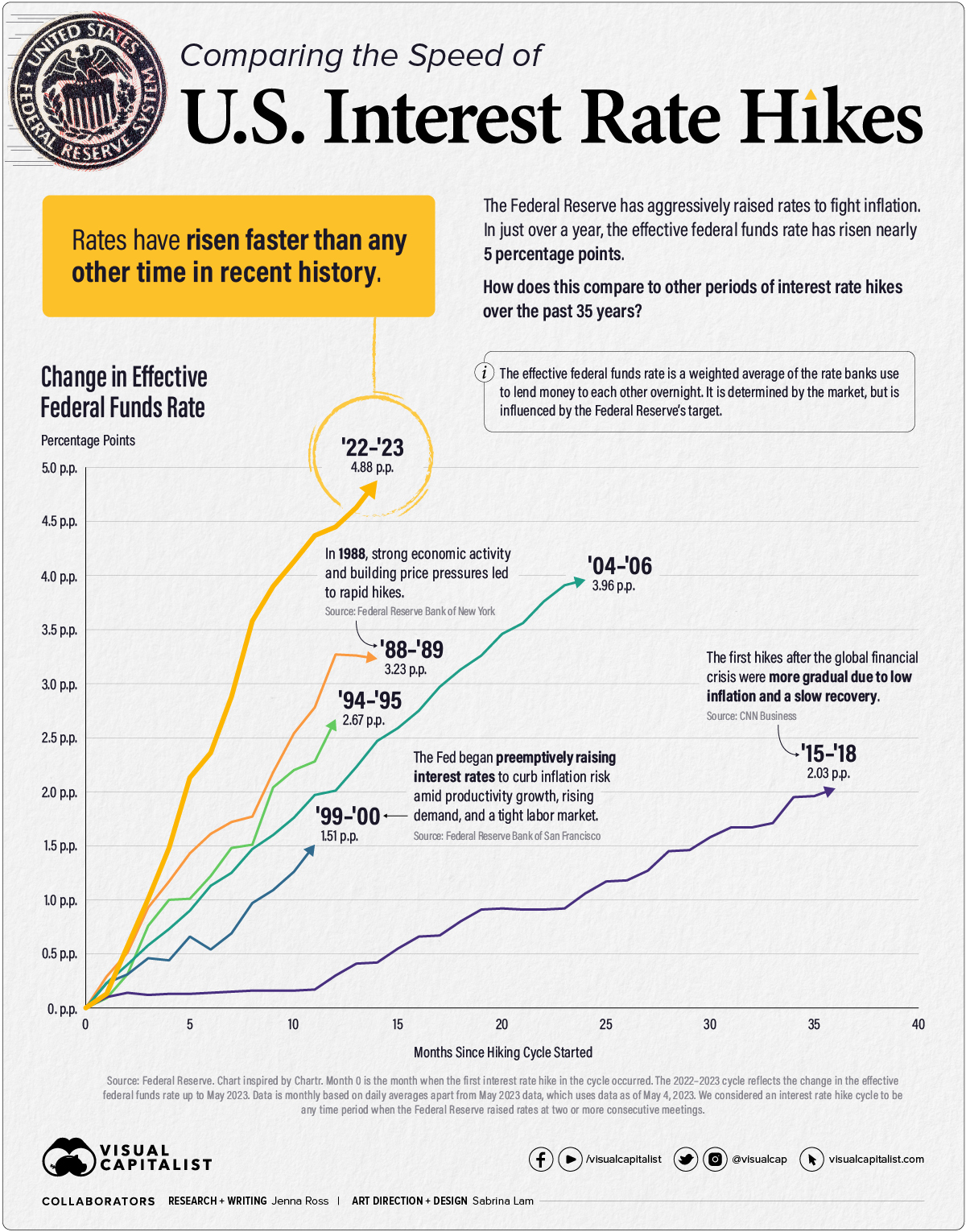

Lead: Understanding recent shifts in monetary policy is crucial for households and businesses across the United States. The Federal Reserve's decisions regarding interest rates have far-reaching implications, influencing everything from mortgage payments to the cost of consumer loans and savings returns. This article aims to provide a clear, comprehensive breakdown of the latest interest rate adjustments, explaining their significance and offering essential insights into how these changes affect daily financial life and the broader economy. Readers will gain a deeper understanding of the forces driving these decisions and what to monitor in the current economic landscape.

Conclusion

The continuous adjustments to interest rates by the Federal Reserve are a cornerstone of modern economic management, designed to foster price stability and maximum employment. Breaking down these latest interest rate hikes provides a vital public service, demystifying complex financial decisions and their tangible effects. It is a topic of profound importance for anyone managing personal finances, operating a business, or simply observing the broader economic trends. Understanding these shifts is not merely academic; it is a practical necessity for making informed decisions in an evolving economic landscape.