Editorial Note: This article is written based on topic research and editorial review.

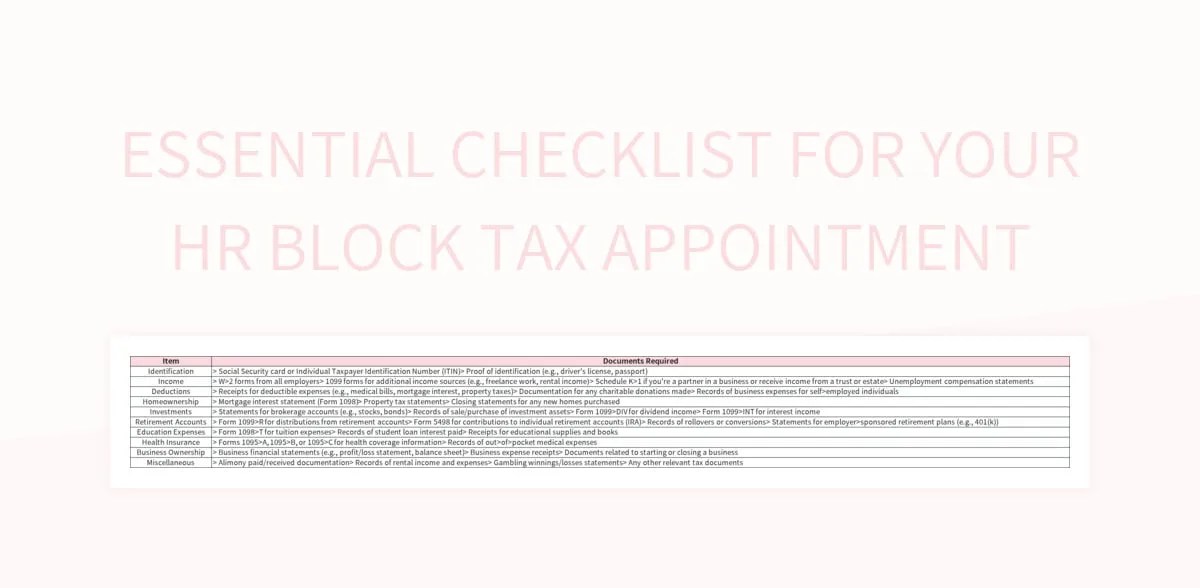

In the intricate landscape of personal finance, the annual ritual of tax filing stands as a cornerstone. For many, navigating the complexities of tax codes and deductions necessitates professional guidance, making the process of securing and optimizing a tax preparation appointment a critical undertaking. The concept of an "ultimate guide" for an HR Block appointment addresses this prevalent need, aiming to demystify the journey from scheduling to submission and beyond, providing a framework for efficiency and accuracy in a typically daunting process.

Editor's Note: Published on 2024-07-28. This article explores the facts and social context surrounding "hr block appointment your ultimate guide".

The Evolution of Accessible Tax Assistance

The landscape of tax preparation services has undergone significant transformation, driven by technological advancements and shifting consumer expectations. What once involved stacks of paper and in-person visits has evolved to include online portals, virtual appointments, and hybrid models. HR Block, a long-standing fixture in the industry, has adapted its offerings to meet these demands, emphasizing convenience and user-friendliness in its appointment scheduling and preparation resources. The notion of an "ultimate guide" reflects this evolution, acknowledging that effective tax preparation today involves more than just bringing documents; it entails understanding digital tools, leveraging pre-appointment resources, and knowing how to articulate complex financial situations succinctly to a tax professional. Such guides bridge the gap between digital convenience and human expertise, ensuring that clients can seamlessly transition between self-service and assisted filing options.